Urgent Editor's Note:

Trump's Strategic AI Chip Diplomacy Creates Investment Opportunities

Trump's surprise reversal on China chip restrictions represents more than just a policy shift—it's a calculated opening move in what analysts call a potential "grand bargain" with Beijing. While NVIDIA celebrates its $15 billion revenue recovery, savvy investors are positioning in AMD and IBM as the political chess game creates unexpected winners beyond the obvious headline play.

Based on these events, one of our 'Trusted Partners' just launched a Must-See presentation below.

Trusted Partner Presentation

If you thought the trade war was over…

Think again.

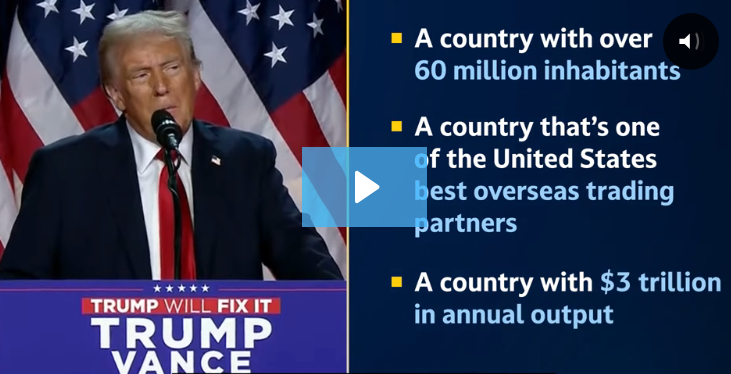

It looks like Trump is about to drop his final economic superweapon.

It's got nothing to do with tariffs…

But it could cause a $12 trillion market megashift…

And those who are positioned in time could pocket once-in-a-lifetime gains.

Click here to see the full story.

NVIDIA (NVDA) hit record highs after Trump's administration assured resumed H20 chip sales to China, potentially restoring $15 billion annually. However, this political pivot appears designed to leverage AI technology as a bargaining chip in broader US-China negotiations, with Commerce Secretary Howard Lutnick stating the goal is keeping Chinese developers "addicted" to American technology. Meanwhile, AMD (AMD) and IBM (IBM) are quietly capitalizing on the shifting landscape with superior performance metrics.

Political Strategy Creates Competitive Opportunities

Revenue Recovery

$15B

NVIDIA's potential annual revenue restoration from China H20 chip sales

Trump's reversal marks a stark departure from Biden's "small yard, high fences" approach, with analysts speculating this chip diplomacy could precede a Trump-Xi summit around October's Asia-Pacific Economic Cooperation meeting. AMD also received Commerce Department assurances for China operations, while the company's MI355X processors offer 40% better cost efficiency than NVIDIA's B200 chips. IBM's enterprise AI focus positions it strategically as corporate adoption accelerates amid the political uncertainty.

✓ Trusted Partner Presentation

It's wildly profitable - Over $3 billion in operating income. It has a partnership with the hottest AI stock on Wall Street.

And Trump has publicly backed it?

Grand Bargain Dynamics Favor Diversification

Performance Gap

40%

AMD's cost efficiency advantage over NVIDIA's B200 accelerators

Treasury Secretary Scott Bessent expects to meet Chinese counterparts within weeks, with Trump seeking large-scale Chinese purchases of American goods to address trade deficits. This transactional approach could benefit multiple US tech companies beyond NVDA, particularly AMD with its $3.7 billion data center revenue base offering massive growth potential compared to NVIDIA's $39.1 billion. The political maneuvering creates conditions where smaller AI players could capture significant market share as negotiations unfold.

Competition Intensifies as Policy Shifts

Market Opportunity

4x

Performance improvement in AMD's new MI355X GPU generation

Commerce Secretary Lutnick's strategy to keep Chinese developers "addicted" to American technology while selling only second-tier products creates opportunities for companies like AMD and IBM to gain market share. IBM has quietly outperformed NVIDIA in 2025 returns despite minimal media attention, while AMD's smaller revenue base means modest market share gains could translate to explosive percentage returns. Major cloud providers are already deploying AMD chips for AI inference workloads, suggesting institutional adoption is accelerating.

What This Could Mean for Investors

Trump's use of AI chips as diplomatic leverage suggests technology policy will remain fluid, potentially creating volatility in sector leaders while benefiting diversified positions. AMD's smaller revenue base could amplify gains from both China recovery and domestic market share growth, while IBM offers stability during political negotiations. Institutional positioning may favor companies with multiple growth drivers beyond Chinese market exposure as the grand bargain strategy evolves. The political chess game creates conditions where early positioning in undervalued AI alternatives could benefit as competition intensifies and policy shifts reshape market dynamics.

Before You Go...You Need To See This